The Challenge

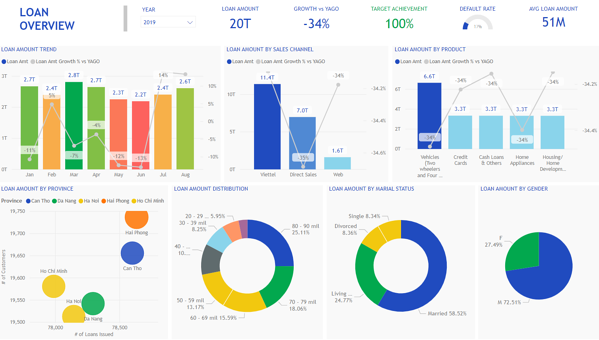

With the massive amount of loan origination data, Investable was looking for efficient methods to analyze their data and deliver valuable insights. A modern loan analytics software was critical to address those needs. For this reason Investable approached our team to implement a robust lending solution with rich functionality, data visualisation and KPI alert capabilities.Approach

Within 6 weeks, our Team implemented an Analytical Platform which provided the functionality of borrowers’ acquisition, document management, CRM and reporting.As a result, Investable identified areas of inefficiency and determined the underlying causes, making process and policy changes that eliminated these inefficiencies. Integrated analytics also enabled a detailed understanding of all loan applications received, identifying historical and emerging trends.

Implementation Benefits

The benefits achieved by Investable are:- Compare performance metrics week to week, month to month, quarter to quarter, or year over year;

- Evaluate average underwriter turnaround times, using the time between application submission and the first significant underwriting decision, such as approval, conditional approval, or decline

- Track the frequency overrides by underwriter to determine if any of these decisions increase lending risk or demonstrate savvy decision skills

- Highly configurable business rules

- Monitor auto-decline and auto-approval ratios based on credit scores, origination or any other borrower attributes of interest

- Summarize weekly capture, book-to-look, and approval ratios