Paperless Lending Software easier and faster

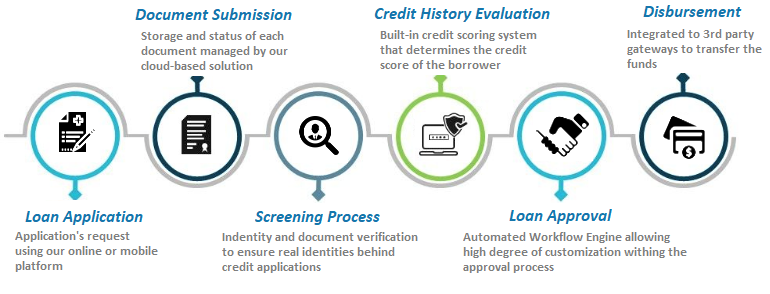

Streamline your loan process by using automated tools and supported by artificial intelligence

Request a Demo-

Cross-Platform Software

Accesible via web or mobile

-

Faster Loan Approval

Paperless end-to-end application

-

Doc & Identity verification

AI-powered validation to mitigate frauds

-

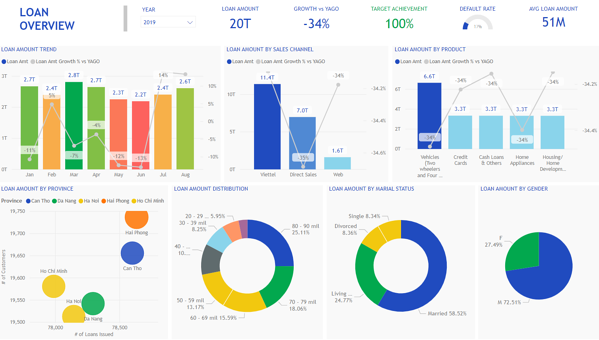

Analytics and Monitoring

Real time reporting

Who we are

LenderDoor is a SaaS loan origination system created by Journey Steps LLC that simplifies the entire loan process and shortens processing times by eliminating the conventional paperwork handling.

It features identity verification and an AI-based scoring system that determines borrower’s credit-worthiness.

Features

- Cloud-based technology accesible from the web or any mobile device

- Flexible configuration of reject rules and approval's workflow

- Identity Verification service done with image processing algorithms

- Documents stored safely and processed in a secure way

- Credit bureau integration for detailed borrower's credit history

- Notifications via email, SMS and application messages

Case studies : Serfinco

Serfinco is a financial institution that has relied on LenderDoor to support the origination of their loans. By using our highly configurable sofware, Serfinco approves applications within minutes and achieves higher employee productivity.

"LenderDoor helped us automating our entire loan process. They are always willing to work with our unique requirements and have provided several features which are very customizable. Most importantly, we now have a software platform that attracts more clients!"

Fernando Salas

Director of Consumer LendingCase studies : Investable

Investable is a Fintech that recommends credit cards, loans and insurance based on each individual’s specific credit profile. Wit Lenderdoor analytics now they gain insights, explore and analyze loan trends, so they can adapt the business strategy much faster.

"We manage an extensive amount of data, so avoiding downtime for our customers is crucial. By using LenderDoor analytical dashboards, we were able to monitor closely our KPIs and detect any issues within the loan cycle life."